Due to health trends, consumer demand in major markets has decreased, and many juice, nectar and still water beverage manufacturers are now facing reduced water supply and climate change. We will explore the trends, challenges and opportunities faced by today's beverage production equipment manufacturers in terms of health, sustainability, environment and consumer demand.

Climate change, water shortages and consumer health are all challenges

Juice is as bad as soda. Drinking a glass of fruit juice every day can greatly reduce the risk of diabetes. Fruit juices are associated with cancer. Over the past decade, negative news has hit juice and nectar producers almost every week - and consumers have noticed it.Although China's juice consumption is expected to continue to grow by more than 4% in the short term, the data released by the US Department of agriculture in the summer of 2019 show that the average American alcohol consumption is about half of that when it reached the peak in the United States in the late 1990s. Fruit juice consumption in Western Europe is also rising sharply, with a decline of only about 1% in 2013.

This is a big problem. Consumption in the United States and Europe has faced a decade of decline, possibly due to the problem of sugar. So how should the beverage production equipment industry deal with it? For decades, the soft drink and static beverage industries have been facing the same problems. "This is not something that started only a few years ago; one might say that hypoglycemia can be traced back to the 1970s. At the same time, beverage manufacturers are under pressure due to climate change, which is affecting fruit growers and putting new requirements on the industry to improve the sustainability of procurement, energy and water in production, packaging and transportation.

Juice producers are already looking for ways to solve the problem of growth. In the next three years, we will see growth from an overall perspective. The global compound annual growth rate is between 1% and 2%.

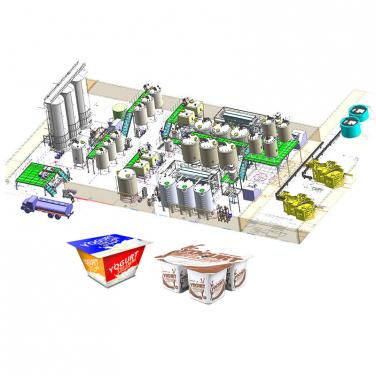

The markets in Asia and Southeast Asia, where consumption has never declined, will continue to expand. At the same time, growth will resume in parts of Europe and the Americas as the industry launches innovative products. Beverage manufacturers responded quickly. They understand that they need to develop solutions to deal with this trend, and they are moving towards what we call 'value-added juice'. These include fruit juices that add so-called "super fruit", fruit juices mixed with grains or proteins to cater to dietary substitution trends, "clean label" products with as few ingredients as possible, and low candy juices.

Before that, the still life beverage and soft drink industry turned to low calorie and non calorie products. At present, the average sales of these products account for 24% in Europe and more than 40% in some markets. Vegetable juice contains about a quarter of the sugar in orange juice, so mixing it with other juices can reduce the total sugar content. We see that vegetable juice is becoming more and more popular. It is an increasing trend to change from single taste to mixed taste. Still life beverage manufacturers are also reformulating to reduce sugar content. They also began to reduce their portions and launched a series of new health products, such as iced tea and flavored water.

Climate change and water challenges

Climate change is increasingly affecting the juice and nectar industry, with hurricanes hitting citrus growing areas in Florida and the Caribbean, while growers in Central America, South America, California and elsewhere are affected by drought. The changing climate has also affected farmers in his native India. Farmers from India's agricultural belt are unhappy because it rains when it shouldn't rain, and it's dry when it should rain. Large growers are also increasingly aware of their water footprint. They will take measures to use water more carefully, collect water from natural sources and use intelligent irrigation technology.

Water is the key component of still water beverage industry, accounting for about 90% of beverage components. For more than 20 years, efficiency, reduction, protection and protection of water resources have been a core focus in high-profile projects such as the cleaning of the Danube River. Production operations are designed to optimize water use and properly treat wastewater. The beverage production equipment industry must keep pace with the times, keep up with the new development needs and face new industry changes and challenges.